Financial Professionals

401(K)

A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts.

403(B)

A 403(b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain 501(c)(3) tax-exempt organizations.

Profit Sharing

A profit-sharing plan accepts discretionary employer contributions with no set limit to contribute.

ESOP’s

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/ money purchase plan.

Defined Benefits Plan

On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

Cash Balance Plans

A cash balance plan is a defined benefit plan that defines the benefit in terms that are more characteristic of a defined contribution plan.

Partners

KTRADE is a pure, open-architecture, CEFEX Certified record keeping Company that serves the retirement plan industry through Investment Advisors and its Alliance Members. The KTRADE Alliance is a national network of Third Party Administrators (TPAs), regionally located throughout the United States. Nexus Administrators is an Alliance Member currently serving the central California segment.

Working through its Alliance Members and business partners, KTRADE crafts retirement plan investment solutions to fit unique employer needs. KTRADE can allow an employer to offer low cost, non-proprietary fund alternatives to its employees. Employers have easy access to manage and administer the Plan while employees have user-friendly access to manage their accounts.

3(16) Fiduciary

Nexus Administrators has a strategic partnership with 3(16) Retirement Solutions, LLC. https://316retirement.com/

A Fiduciary is a person who owes a duty of care and trust to another and must act primarily for the benefit of the other in a particular activity. Many of the actions needed to operate a qualified retirement plan involve fiduciary decisions. Fiduciaries are in a position of trust with respect to the plan participants and beneficiaries and are required to act solely in the interest of those participants and beneficiaries. The responsibility to be prudent covers a wide range of functions needed to operate a plan.

- Payroll-Related Services

- Nondiscrimination and Coverage Testing Responsibilities

- Distribution and Loan Responsibilities

- Procedures for Plan

- Participant Enrollment Responsibilities

- Record and Document Maintenance

- QDRO Responsibilities

- Reporting and Disclosure Responsibilities

- Notice Requirements and Fulfillment

- Payroll

SMART Start

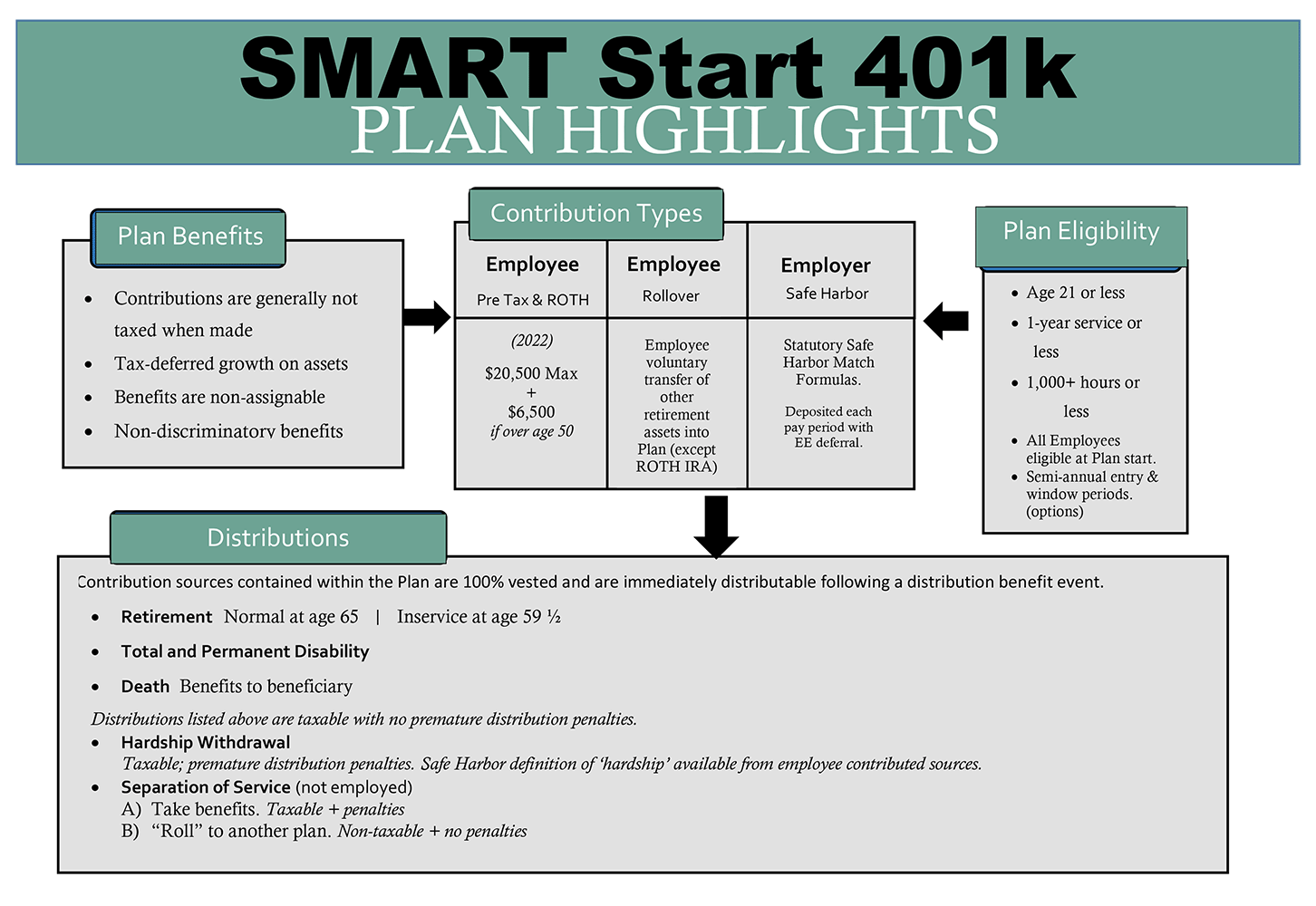

Nexus Administrators, Inc. has just introduced it’s SMART Start 401(K) solution for small to mid-sized employers looking for a ‘Smart’ way to start a 401(K) plan.

Simple

We have taken the hassle out of designing your 401(k) Plan. Smart Start allows for pre and post-tax salary deferrals. A Safe Harbor match program with minimal energy to install, implement and support. Safe Harbor Plans are used by most small to mid-sized companies throughout the country.

Manageable

Reduced energy on the part of the employer. This is intended for employers with less than 100 employees with contributions funded each payroll.

Affordable

As compared to statutory Safe Harbor Plans, we have made a dramatic reduction in our implementation cost. A base fee and per participant fee solution tied to the size of the employer.

Robust

Our strong alliance partners offer diversity in record keeper & investment choices. Under Smart Start, we work in concert with Voya, American Funds, Empower, John Hancock & Transamerica.

Trusted

With over 60 years of experience and several thousand satisfied clients we are committed to giving you the same trusted dedication and service.

Types of Employer Segments Served

- Contractors subject to prevailing wage

- Small to Large Non-Profit

- Tribal Government

- Companies intending to be Employee owned

- Water Districts

- Private Schools

- Churches & Church affiliated Employers

- Agricultural related Employers

- PEOs & Closed MEPs